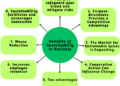

Exploring the realm of Affordable Wellness Lifestyle Coverage Options, this detailed guide aims to shed light on the various coverage options available to help you lead a healthy lifestyle without breaking the bank. From individual plans to family coverage and employer-sponsored programs, this article covers it all.

Understanding Affordable Wellness Lifestyle Coverage Options

When it comes to maintaining a healthy lifestyle, having affordable wellness lifestyle coverage is crucial. This type of coverage helps individuals access a variety of services and resources that promote overall well-being and prevent illness.

Types of Affordable Coverage Options

- Health Insurance Plans: These plans often include coverage for preventive care, such as annual check-ups and screenings, as well as access to mental health services and wellness programs.

- Employee Wellness Programs: Many employers offer wellness programs as part of their benefits package, which can include gym discounts, nutrition counseling, and stress management resources.

- Community Health Centers: These centers provide affordable healthcare services, including vaccinations, counseling, and chronic disease management, to help individuals maintain a healthy lifestyle.

Importance of Wellness Coverage for a Healthy Lifestyle

Having wellness coverage ensures that individuals can prioritize their health and well-being without worrying about the financial burden of healthcare services. This proactive approach to healthcare can lead to early detection of health issues, better management of chronic conditions, and overall improved quality of life.

Types of Affordable Wellness Coverage

When it comes to affordable wellness coverage, there are various options available to cater to different needs and preferences. Understanding the features and benefits of individual, family, employer-sponsored, and private wellness plans can help you make an informed decision about the best option for you.

Individual Wellness Plans

Individual wellness plans are designed to provide coverage for a single person, offering a range of benefits such as preventive care, routine check-ups, and access to wellness programs and resources. These plans are suitable for individuals who prefer personalized healthcare solutions tailored to their specific needs.

Family Wellness Coverage Options

Family wellness coverage options are ideal for families looking to ensure the health and well-being of all members. These plans typically include coverage for children, spouses, and dependents, offering comprehensive benefits such as pediatric care, maternity services, and family-focused wellness initiatives.

Employer-Sponsored Wellness Programs vs. Private Wellness Plans

Employer-sponsored wellness programs are typically offered by companies to their employees as part of their benefits package. These programs may include incentives for participating in health screenings, fitness challenges, and wellness activities. On the other hand, private wellness plans are purchased directly by individuals or families from insurance providers, offering more customization and flexibility in terms of coverage and benefits.

Factors to Consider When Choosing Wellness Coverage

When selecting a wellness plan, there are several key factors that individuals should consider to ensure they are getting the coverage that best suits their needs and budget.

Impact of Coverage Limits and Deductibles

- Ensure you understand the coverage limits of the plan, including any maximum amounts the insurer will pay for specific services or treatments.

- Consider the deductible amount, which is the out-of-pocket cost you must pay before the insurance kicks in. A higher deductible typically means lower monthly premiums but higher out-of-pocket costs when you need care.

- Balance the coverage limits and deductibles to find a plan that offers adequate coverage at a cost you can afford.

Role of Preventive Care in Wellness Coverage Options

- Preventive care plays a crucial role in wellness coverage options by focusing on early detection and prevention of health issues.

- Many wellness plans offer free or low-cost preventive services such as annual check-ups, screenings, and vaccinations to help individuals stay healthy and catch any potential problems early.

- Choosing a plan that prioritizes preventive care can lead to better health outcomes and potentially lower overall healthcare costs in the long run.

Customizing Wellness Coverage to Fit Your Needs

When it comes to personal health goals, customizing your wellness coverage is essential. Here are some examples of how you can tailor a wellness plan to suit your specific needs:

1. Tailoring Services

Consider choosing a plan that offers services aligned with your health goals. For example, if you are focused on mental wellness, opt for a plan that includes therapy sessions or counseling.

2. Personalized Care

Look for coverage options that allow you to personalize your care. This could involve choosing specific providers or specialists that cater to your unique health needs.

3. Integrating Lifestyle Choices

Find a wellness plan that supports your lifestyle choices, whether it's incorporating alternative medicine, fitness programs, or nutritional counseling.

4. Preventive Care Focus

Emphasize preventive care in your plan by selecting coverage that includes regular check-ups, screenings, and vaccinations to maintain your overall health.

5. Flexible Coverage Options

Opt for a plan that offers flexibility, allowing you to adjust your coverage based on changing health needs or life circumstances.

Epilogue

In conclusion, Affordable Wellness Lifestyle Coverage Options offer a range of choices to ensure that you can prioritize your health and well-being without worrying about the costs. By understanding the factors involved in choosing the right coverage and customizing it to fit your needs, you can embark on a wellness journey that is both affordable and effective.

FAQ Corner

What is wellness lifestyle coverage?

Wellness lifestyle coverage encompasses health plans that focus on preventive care and promoting a healthy lifestyle rather than just treating illnesses.

How do coverage limits and deductibles impact affordability?

Coverage limits and deductibles affect how much you pay out-of-pocket before your insurance kicks in, so choosing the right balance is crucial for affordability.

Why is customization important in wellness coverage?

Customizing a wellness plan allows individuals to tailor their coverage to meet their specific health goals, ensuring they get the most out of their plan.