Embark on a journey where financial planning and health routines intertwine, offering a unique perspective on how our monetary decisions impact our well-being. This exploration dives into the symbiotic relationship between financial stability and physical health, revealing the interconnectedness of these two crucial aspects of our lives.

Moving forward, we will delve into the significance of budgeting for health and wellness, the role of long-term financial planning in supporting health goals, and the array of financial tools available for managing our health effectively.

Introduction to Combining Financial Planning with Health Routines

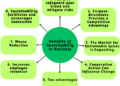

Integrating financial planning with health routines involves aligning your financial goals with your health objectives to achieve overall well-being. By considering how your financial decisions impact your health and vice versa, you can create a holistic approach to managing both aspects of your life.

Benefits of Aligning Financial Goals with Health Objectives

- Improved overall well-being: When you prioritize both your financial and health goals, you can experience a better quality of life.

- Reduced stress: By managing your finances and health together, you can reduce stress levels and improve mental health.

- Long-term financial stability: Investing in your health can lead to lower healthcare costs in the future, contributing to long-term financial stability.

Examples of How Financial Decisions Impact Health and Vice Versa

- Healthy eating habits: Investing in nutritious food may seem more expensive in the short term but can lead to long-term health benefits and reduced healthcare costs.

- Regular exercise: While gym memberships or fitness classes may have a financial cost, the physical and mental health benefits of regular exercise are invaluable.

- Stress management: Financial stress can negatively impact your health, highlighting the importance of budgeting and planning to alleviate this burden.

Importance of Budgeting for Health and Wellness

When it comes to maintaining a healthy lifestyle, budgeting plays a crucial role in ensuring that you can prioritize your health without compromising your financial well-being. By allocating funds strategically for healthcare, fitness, and wellness activities, you can invest in your long-term well-being and prevent potential health issues down the line.

Tips for Allocating Funds for Health and Wellness

- Set specific budget categories for healthcare expenses, such as insurance premiums, co-pays, and medications, to ensure you are prepared for unexpected medical costs.

- Allocate a portion of your budget for fitness activities, such as gym memberships, workout classes, or equipment, to prioritize physical health and stay active.

- Include funds for wellness practices like mental health services, relaxation techniques, and self-care activities to support your overall well-being.

Strategies for Creating a Health-Focused Budget

- Calculate your total income and expenses to determine how much you can realistically allocate towards health and wellness each month.

- Prioritize essential health expenses over non-essential items to ensure you are investing in your well-being first.

- Consider setting up automatic transfers to a separate health fund to avoid the temptation of using those funds for other purposes.

- Regularly review and adjust your budget to accommodate changing health needs and financial goals.

Investing in Long-Term Health through Financial Planning

Investing in long-term health through financial planning is a strategic way to ensure that you can maintain your well-being in the future. By making smart financial decisions now, you can set yourself up for a healthier and more secure future.

Investments in Preventive Healthcare and Wellness Programs

Investing in preventive healthcare and wellness programs can help you avoid costly medical expenses down the line. By prioritizing your health and well-being today, you can reduce the risk of developing chronic conditions that may require extensive treatment in the future.

Consider allocating a portion of your budget towards preventive measures such as regular check-ups, healthy lifestyle choices, and fitness programs. These investments can pay off in the long run by helping you stay healthy and active as you age.

Saving for Healthcare Expenses and Retirement Simultaneously

Saving for healthcare expenses and retirement simultaneously is essential for long-term financial planning. As healthcare costs continue to rise, it's crucial to set aside funds specifically for medical needs in the future

Additionally, saving for retirement is equally important to maintain your quality of life as you age. Balancing these two financial goals requires careful planning and budgeting, but it can provide you with peace of mind knowing that you are prepared for whatever the future may hold.

Financial Tools and Resources for Health Management

Financial tools play a crucial role in managing health effectively. By leveraging tools such as health savings accounts (HSAs) and flexible spending accounts (FSAs), individuals can better navigate their healthcare expenses and investments. Additionally, understanding how to maximize insurance policies can lead to improved health coverage and access to quality healthcare services.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

- HSAs and FSAs are tax-advantaged accounts that allow individuals to set aside pre-tax funds for qualified medical expenses.

- HSAs are typically paired with high-deductible health plans and offer tax benefits, such as tax-deductible contributions and tax-free withdrawals for medical expenses.

- FSAs are employer-sponsored accounts that also allow pre-tax contributions for medical expenses but may have a "use-it-or-lose-it" provision where funds not used within the plan year may be forfeited.

- By utilizing HSAs and FSAs, individuals can save money on healthcare costs and effectively budget for medical expenses.

Leveraging Insurance Policies for Better Health Coverage

- Understanding the coverage and benefits of insurance policies is essential for maximizing health coverage.

- Reviewing and updating insurance policies regularly can help ensure adequate coverage for medical needs.

- Consider policies that offer comprehensive coverage for preventive care, emergencies, and ongoing health conditions to avoid unexpected costs.

- Utilize insurance resources such as telehealth services, wellness programs, and prescription drug benefits to enhance overall health and well-being.

Utilizing Financial Resources to Access Quality Healthcare Services

- Research healthcare providers and facilities to compare costs and quality of care before seeking medical services.

- Explore options for discounts, payment plans, or financial assistance programs offered by healthcare providers to reduce out-of-pocket expenses.

- Invest in preventive care and wellness programs to maintain good health and potentially reduce long-term healthcare costs.

- Consider setting aside a portion of your budget specifically for healthcare expenses to prioritize your well-being and access quality healthcare services when needed.

Outcome Summary

As we conclude this discussion on combining financial planning with health routines, it becomes evident that achieving overall well-being requires a harmonious balance between monetary strategies and health-conscious decisions. By prioritizing both financial stability and physical wellness, individuals can pave the way for a healthier and prosperous future.

Essential Questionnaire

How can financial planning impact my health decisions?

Financial planning can influence your health choices by determining your ability to afford healthcare services, nutritious food, fitness activities, and other wellness expenses.

What are some tips for effectively budgeting for health and wellness?

Allocate a specific portion of your income towards healthcare, fitness, and wellness expenses. Prioritize essential health needs while ensuring your financial goals are not compromised.

Why is it important to invest in long-term health through financial planning?

Investing in long-term health ensures a secure future by preparing for healthcare expenses and retirement. It promotes preventive healthcare measures and overall well-being.

What financial tools can aid in managing health effectively?

Tools like health savings accounts (HSAs) and flexible spending accounts (FSAs) can help cover medical costs. Leverage insurance policies for comprehensive health coverage.