Exploring the world of insurance tailored specifically for sustainable living advocates, this introduction sets the stage for a deep dive into the intersection of sustainable practices and risk management.

As we delve further, we will uncover the various types of insurance coverage available, key considerations when choosing insurance, real-life case studies, and more.

Introduction to Insurance for Sustainable Living Advocates

Insurance for sustainable living advocates refers to specialized insurance products designed to protect individuals or organizations who are actively promoting and implementing sustainable living practices. These advocates work towards reducing environmental impact, promoting social responsibility, and fostering economic sustainability.

Insurance plays a crucial role in supporting sustainable living initiatives by providing financial protection and risk management solutions. It helps advocates mitigate potential losses or liabilities that may arise from their activities, ensuring continuity and stability in their efforts towards a more sustainable future.

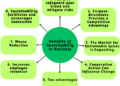

Benefits of Insurance for Sustainable Living Advocates

- Liability Coverage: Insurance can protect advocates from legal claims or lawsuits related to their sustainable practices, such as property damage or bodily injury.

- Property Protection: Insurance can cover the cost of repairing or replacing sustainable infrastructure or assets damaged by unforeseen events like natural disasters.

- Business Interruption: In the event of a disruption to sustainable operations, insurance can provide financial support to help advocates resume activities and recover lost income.

- Professional Indemnity: Insurance can safeguard advocates against claims of negligence or errors in their sustainability consulting or advisory services.

Types of Insurance Coverage for Sustainable Living Advocates

Insurance coverage is essential for sustainable living advocates to protect themselves and their assets. There are different types of insurance options available to meet their specific needs.

Liability Insurance

Liability insurance is crucial for sustainable living advocates as it provides protection in case they are held responsible for property damage or injuries to others. This type of insurance can cover legal fees, medical expenses, and settlements.

Property Insurance

Property insurance is important for sustainable living advocates who own or rent property. This insurance can protect their homes, belongings, and other structures from damage or loss due to events like fire, theft, or natural disasters.

Health Insurance

Health insurance is essential for sustainable living advocates to ensure they have access to quality healthcare services. This type of insurance can cover medical expenses, doctor visits, prescription medications, and preventive care.

Specialized Insurance Products

There are specialized insurance products tailored for sustainable living advocates, such as environmental liability insurance, green building insurance, and sustainable agriculture insurance. These products offer specific coverage for risks related to sustainable practices.

Factors to Consider when Choosing Insurance for Sustainable Living Advocates

When choosing insurance for sustainable living advocates, there are several key factors to consider to ensure you have the right coverage that aligns with your values and needs.

Coverage Limits, Premiums, and Deductibles

- It is essential to carefully review the coverage limits of the insurance policy to ensure that it provides adequate protection for your sustainable living initiatives.

- Compare premiums from different insurance providers to find a balance between cost and coverage.

- Consider the deductibles you are comfortable with paying out of pocket in the event of a claim.

Role of Sustainability Criteria in Selecting Insurance Policies

- Look for insurance providers that offer policies specifically tailored to sustainable living practices.

- Check if the insurance company supports environmental causes or is committed to sustainability in their operations.

- Consider how the insurance policy aligns with your own sustainability goals and values.

Assessing the Environmental Impact of Insurance Providers

- Research and evaluate the environmental policies and practices of insurance providers to gauge their commitment to sustainability.

- Look for insurance companies that offer green insurance options or support eco-friendly initiatives.

- Consider the carbon footprint and social responsibility of the insurance company before making a decision.

Case Studies of Insurance Integration in Sustainable Living Advocacy

Insurance plays a crucial role in supporting sustainable living advocates by providing financial protection and risk mitigation. Let's explore some case studies where insurance has successfully integrated into sustainable living advocacy projects.

Case Study 1: Agricultural Insurance for Sustainable Farming

- One successful integration of insurance in sustainable living advocacy is the use of agricultural insurance for small-scale farmers.

- By having insurance coverage for crop failures due to climate change or natural disasters, farmers are able to recover financially and continue their sustainable farming practices.

- Insurance helps mitigate the risks associated with unpredictable weather patterns, ensuring that farmers can sustain their livelihoods and contribute to a more sustainable food system.

Case Study 2: Renewable Energy Insurance for Green Initiatives

- Another example of insurance integration in sustainable living advocacy is the use of renewable energy insurance for green energy projects.

- Insurance coverage for solar panels, wind turbines, and other renewable energy infrastructure helps protect investments and ensures the longevity of these projects.

- In the event of equipment damage or failure, insurance provides the necessary financial support to repair or replace the assets, enabling sustainable energy initiatives to continue operating smoothly.

Case Study 3: Liability Insurance for Eco-Friendly Businesses

- Liability insurance is essential for eco-friendly businesses that promote sustainable practices.

- By having liability coverage, businesses can protect themselves from potential lawsuits or claims related to environmental damage, product defects, or other risks associated with their operations.

- This insurance helps businesses navigate legal challenges and financial burdens, allowing them to focus on their mission of promoting sustainable living and responsible business practices.

Closing Summary

In conclusion, the integration of insurance in sustainable living advocacy proves to be a crucial aspect in supporting and protecting those dedicated to promoting eco-friendly practices. As we navigate through this complex landscape, it becomes evident that a well-rounded insurance plan is a vital tool for advocates of sustainable living.

Key Questions Answered

What are the common types of insurance coverage suitable for sustainable living advocates?

Common types include liability insurance, property insurance, and health insurance, tailored to the needs of advocates promoting sustainable living.

How do sustainability criteria play a role in selecting insurance policies for advocates of sustainable living?

Sustainability criteria help ensure that insurance policies align with the eco-friendly values and initiatives of sustainable living advocates.

Can insurance help mitigate risks in sustainable living projects?

Yes, insurance can play a crucial role in mitigating risks by providing financial protection and support in case of unforeseen events.