Exploring the realm of Smart Insurance Bundles for Balanced Living unveils a world of tailored protection that aligns with various facets of a well-rounded life. This guide offers insights into the significance of such bundles and the benefits they bring to achieving harmony and security in all aspects of life.

Introduction to Smart Insurance Bundles for Balanced Living

Smart insurance bundles are comprehensive packages that combine different types of insurance policies to provide holistic coverage for various aspects of life. These bundles are designed to contribute to balanced living by ensuring individuals have the necessary protection in place to mitigate risks and uncertainties.

The Importance of Tailored Insurance Coverage

Having insurance coverage tailored to different aspects of life is essential for achieving balance. Each individual has unique needs and risks, and by customizing insurance policies to address these specific requirements, individuals can feel secure and confident in their overall well-being.

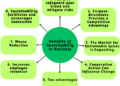

Benefits of Integrated Insurance Policies

Integrating various insurance policies into a comprehensive bundle offers several benefits for overall well-being. By bundling multiple policies together, individuals can often save on premiums, simplify the insurance management process, and ensure they have comprehensive coverage across different areas of their life.

Types of Insurance Coverage in Smart Bundles

When it comes to smart insurance bundles for balanced living, there are several types of insurance coverage that are commonly included. Each type serves a specific purpose in safeguarding different aspects of your life and assets. Let's explore how each type of insurance contributes to balanced living and the advantages of bundling them together.

Health Insurance

Health insurance is essential for covering medical expenses in case of illness or injury. It helps ensure that you have access to quality healthcare without worrying about the financial burden. By having health insurance in your smart bundle, you can prioritize your well-being and maintain a healthy lifestyle, contributing to overall balanced living.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It offers peace of mind knowing that your family will be taken care of and financially secure. Including life insurance in your smart bundle allows you to plan for the future and ensure that your family's needs are met, promoting a sense of security and stability in your life.

Property Insurance

Property insurance protects your home and belongings from unexpected events such as natural disasters, theft, or accidents. By bundling property insurance with other types of coverage, you can safeguard your assets and ensure that you have a secure living environment.

This contributes to balanced living by reducing stress and worries related to property damage or loss.

Auto Insurance

Auto insurance is essential for covering damages or injuries resulting from car accidents. It helps you comply with legal requirements and protects you from potential financial liabilities. By including auto insurance in your smart bundle, you can ensure that you have reliable transportation and peace of mind while on the road, promoting safety and security in your daily life.In conclusion, bundling different types of insurance coverage in a smart bundle offers comprehensive protection for various aspects of your life.

By combining health, life, property, and auto insurance, you can enjoy the benefits of financial security, peace of mind, and overall well-being, leading to a more balanced and harmonious lifestyle.

Customization and Flexibility in Smart Insurance Bundles

When it comes to smart insurance bundles, one of the key advantages is the ability to customize and tailor the coverage to suit individual needs and lifestyles. This level of flexibility ensures that individuals can get the specific coverage they require without paying for unnecessary extras.

Adapting to Changing Circumstances

Smart insurance bundles offer the flexibility to adapt to changing circumstances. For example, if a policyholder's lifestyle changes, such as starting a family or buying a new home, they can easily adjust their coverage to meet their evolving needs. This adaptability ensures that individuals are always adequately protected no matter what life throws their way.

- For instance, a young professional may initially opt for basic health insurance coverage. However, as they start a family, they can easily add on maternity and pediatric coverage to their existing policy.

- Similarly, if someone decides to switch careers or start a business, they can adjust their disability insurance coverage to ensure they are protected in case of unforeseen circumstances.

Importance of Tailoring Insurance Bundles

Tailoring insurance bundles is crucial to achieving a balanced and holistic approach to coverage. By customizing the policy to fit individual needs, policyholders can ensure they are adequately protected in all aspects of their life. This approach helps avoid gaps in coverage and ensures that individuals are not overpaying for unnecessary features.

- Customizing insurance bundles can help individuals feel more secure and confident in their coverage, knowing that they have tailored their policy to meet their specific needs.

- By adjusting coverage as circumstances change, individuals can maintain a comprehensive level of protection without having to switch between different policies or providers.

Technology and Innovation in Smart Insurance Bundles

Technology and innovation play a crucial role in the development of smart insurance bundles, revolutionizing the way insurance products are designed and delivered to customers. Through the integration of cutting-edge tools and solutions, insurers can offer more personalized and efficient services to meet the evolving needs of policyholders.

Role of IoT in Enhancing Insurance Offerings

The Internet of Things (IoT) devices have transformed the insurance industry by providing real-time data and insights that enable insurers to assess risks more accurately. IoT devices such as smart home sensors, wearable fitness trackers, and connected vehicles allow insurers to gather valuable information on policyholders' behaviors and lifestyles.

This data is utilized to tailor insurance packages that incentivize healthy habits, preventive measures, and safe practices, ultimately reducing risks and claims.

Data Analytics in Smart Insurance Bundles

Data analytics plays a significant role in smart insurance bundles by analyzing vast amounts of structured and unstructured data to identify trends, patterns, and correlations. Insurers can leverage data analytics to assess risk profiles, predict potential claims, and personalize insurance coverage based on individual needs and preferences.

By harnessing the power of data analytics, insurers can enhance underwriting processes, improve customer experiences, and optimize pricing strategies for better outcomes.

AI in Reshaping the Insurance Industry

Artificial Intelligence (AI) is transforming the insurance landscape by automating tasks, enhancing decision-making processes, and providing personalized recommendations to customers. AI-powered chatbots, virtual assistants, and predictive models are being used to streamline claims processing, offer proactive risk management solutions, and deliver instant assistance to policyholders.

By integrating AI into smart insurance bundles, insurers can deliver more responsive, efficient, and customer-centric services that promote balanced living and well-being.

End of Discussion

In conclusion, Smart Insurance Bundles for Balanced Living offer a holistic approach to insurance coverage, ensuring individuals are well-protected and prepared for whatever life may bring. By bundling different policies together, one can achieve a seamless and comprehensive safety net that promotes a balanced and stress-free lifestyle.

FAQ Compilation

What are Smart Insurance Bundles?

Smart Insurance Bundles are comprehensive packages that combine various types of insurance coverage to provide a well-rounded protection plan for individuals.

How do Smart Insurance Bundles contribute to balanced living?

By tailoring insurance coverage to different aspects of life, Smart Insurance Bundles help individuals achieve a sense of balance and security in all areas, from health to property.

Can Smart Insurance Bundles be customized?

Yes, Smart Insurance Bundles offer flexibility and customization options to suit individual needs and lifestyles, ensuring that coverage adapts to changing circumstances.

What role does technology play in Smart Insurance Bundles?

Technological advancements, such as IoT devices and data analytics, are reshaping Smart Insurance Bundles to better serve customers' needs and enhance overall coverage for balanced living.