Exploring the landscape of Top Wellness-Based Insurance Programs in 2025 offers a glimpse into the future of healthcare coverage. This guide aims to provide a detailed look at the latest trends, innovations, and impacts of these programs, ensuring readers are well-informed and prepared for what lies ahead.

Delve into the comparison of top programs, analyze their impact on healthcare, and ponder the future prospects and challenges that await in this ever-evolving industry.

Overview of Wellness-Based Insurance Programs

Wellness-based insurance programs are a type of insurance coverage that emphasizes preventive care and proactive health measures to promote overall well-being and reduce the likelihood of medical issues in the future. These programs go beyond traditional health insurance by encouraging healthy lifestyle choices and rewarding policyholders for engaging in activities that improve their health.

Key Features of Wellness-Based Insurance Programs

- Personalized Health Plans: These programs often offer personalized health plans tailored to individual needs and health goals.

- Health Incentives: Policyholders can earn incentives such as discounts on premiums, cash rewards, or other benefits for participating in wellness activities.

- Telemedicine Services: Many wellness-based programs provide access to telemedicine services for convenient and timely medical consultations.

- Wellness Resources: Policyholders have access to a range of wellness resources such as fitness classes, nutrition counseling, and mental health support.

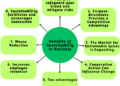

Benefits of Integrating Wellness into Insurance Coverage

- Preventive Care: By focusing on wellness, these programs help prevent chronic diseases and other health issues through early detection and intervention.

- Cost Savings: Promoting healthy behaviors can lead to reduced healthcare costs in the long run by lowering the incidence of expensive medical treatments.

- Improved Quality of Life: Encouraging healthy habits can improve overall quality of life for policyholders by enhancing physical and mental well-being.

- Enhanced Engagement: Wellness-based programs engage policyholders in their health, empowering them to take an active role in managing their well-being.

Trends and Innovations in Wellness-Based Insurance Programs

![Top 9 Global Health Insurance Companies [2025 Updated] Top 9 Global Health Insurance Companies [2025 Updated]](https://digilife.ayobandung.com/wp-content/uploads/2025/11/7-health-insurance-trends.jpg)

In recent years, wellness-based insurance programs have seen a significant evolution, with the incorporation of innovative approaches and cutting-edge technologies to enhance the overall experience for policyholders.

Personalized Wellness Plans

- Insurance companies are increasingly offering personalized wellness plans tailored to individual policyholders based on their health data, lifestyle habits, and medical history.

- These customized plans include specific goals, incentives for achieving milestones, and access to resources like fitness trackers and nutritional guidance.

- By focusing on personalized wellness, insurers aim to promote preventive health measures and ultimately reduce healthcare costs in the long run.

Integration of Wearable Technology

- One of the key innovations in wellness-based insurance programs is the integration of wearable technology devices like smartwatches and fitness trackers.

- These devices provide real-time data on policyholders' physical activity, sleep patterns, heart rate, and other vital metrics, allowing insurers to track progress and offer incentives for healthy behaviors.

- By leveraging wearable technology, insurers can encourage policyholders to stay active, monitor their health, and make informed decisions about their well-being.

Telehealth Services

- With the rise of telehealth services, wellness-based insurance programs now offer policyholders convenient access to virtual consultations with healthcare providers.

- Policyholders can receive medical advice, prescriptions, and mental health support from the comfort of their homes, promoting timely interventions and continuity of care.

- Telehealth services have become a valuable tool in promoting overall wellness and ensuring that policyholders can address health concerns promptly.

Comparison of Top Wellness-Based Insurance Programs

When it comes to wellness-based insurance programs in 2025, there are several top contenders in the market, each with its unique offerings tailored to specific target audiences.

Wellness Program A

Wellness Program A focuses on providing personalized health plans based on individual health data gathered through wearable devices. This program offers incentives for achieving health goals and has a strong emphasis on preventive care. The target audience for Wellness Program A includes tech-savvy individuals looking for a proactive approach to their health.

Wellness Program B

Wellness Program B, on the other hand, offers a comprehensive wellness platform that includes virtual consultations with health professionals, personalized nutrition plans, and mental health support

Wellness Program C

Wellness Program C stands out for its focus on fitness and activity tracking, offering rewards for meeting exercise targets and participating in wellness challenges. This program is ideal for fitness enthusiasts and individuals looking to stay active and motivated in their health journey.

Impact of Wellness-Based Insurance Programs on Healthcare

Wellness-based insurance programs have been transforming the healthcare industry by shifting the focus towards preventive care and holistic wellness. These programs aim to incentivize individuals to adopt healthier lifestyles, leading to potential cost savings and improved health outcomes.

Cost Savings and Improved Health Outcomes

- Wellness-based insurance programs encourage individuals to engage in preventive care measures such as regular health screenings, vaccinations, and lifestyle modifications.

- By promoting early detection and intervention, these programs can help prevent the progression of chronic conditions, reducing the need for costly treatments and hospitalizations.

- Individuals who actively participate in wellness programs may experience lower healthcare costs over time, as they are less likely to require expensive medical procedures or medications.

- Improved health outcomes, such as reduced rates of chronic diseases and better overall well-being, can lead to a more productive workforce and lower absenteeism rates.

Role of Preventive Care in Reducing Healthcare Expenses

- Preventive care plays a crucial role in reducing overall healthcare expenses by addressing health issues before they escalate into more serious conditions.

- Wellness-based insurance programs focus on preventive care services such as health risk assessments, wellness screenings, and health coaching to empower individuals to take control of their health.

- By emphasizing preventive measures, these programs aim to reduce the burden on the healthcare system, lower healthcare costs, and improve population health outcomes.

- Regular preventive care can help identify health risks early on, allowing for timely interventions and lifestyle modifications that can ultimately lead to long-term cost savings and improved quality of life.

Future Prospects and Challenges

As we look ahead to the future of wellness-based insurance programs, there are both exciting prospects and potential challenges on the horizon. The continued growth of these programs is expected to reshape the healthcare landscape, but certain obstacles may hinder their widespread adoption.

Future Growth of Wellness-Based Insurance Programs

Wellness-based insurance programs are projected to experience substantial growth in the coming years as more individuals and employers recognize the value of preventative care and healthy lifestyle choices. With advancements in technology and data analytics, these programs are becoming more personalized and effective in promoting overall well-being.

Challenges in Adoption

- Resistance from traditional healthcare systems: The integration of wellness-based insurance programs may face resistance from established healthcare systems that are reluctant to change their traditional models of care.

- Awareness and education barriers: Lack of awareness about the benefits of wellness programs and limited understanding of how they work could impede their widespread adoption among consumers.

- Privacy and data security concerns: The collection of personal health data for wellness programs raises privacy concerns among individuals, leading to hesitancy in participation.

- Financial constraints: Affordability and cost-effectiveness of wellness-based insurance programs may pose challenges for individuals and employers, especially for those with limited resources.

Impact of Regulatory Changes

Regulatory changes in the healthcare industry can significantly impact the landscape of wellness-based insurance programs. Stricter regulations on data privacy and security, along with evolving healthcare policies, could shape the future development and implementation of these programs. It is crucial for policymakers to strike a balance between promoting innovation and protecting consumer interests in this evolving space.

Ultimate Conclusion

In conclusion, the world of wellness-based insurance programs is at a pivotal moment, with exciting developments on the horizon. Stay informed, stay engaged, and be ready to embrace the changes that will shape the future of healthcare as we know it.

Popular Questions

What are the key features of wellness-based insurance programs?

Wellness-based insurance programs focus on promoting preventive care, offering incentives for healthy behaviors, and providing access to wellness resources.

How do wellness-based insurance programs use technology to enhance their services?

These programs leverage technology such as wearables, apps, and telemedicine to track health metrics, provide personalized recommendations, and offer virtual consultations.

What potential challenges may hinder the widespread adoption of wellness-based insurance programs?

Challenges may include privacy concerns related to health data, resistance from traditional healthcare providers, and regulatory hurdles in implementing wellness-focused policies.

![Top 9 Global Health Insurance Companies [2025 Updated]](https://digilife.ayobandung.com/wp-content/uploads/2025/11/7-health-insurance-trends-700x375.jpg)