Exploring the realm of Insurance Policies That Reward Healthy Behavior, this article delves into the innovative ways insurance companies are encouraging healthy lifestyles. From tracking behaviors to offering rewards, these policies are reshaping the insurance landscape for the better.

Types of Insurance Policies That Reward Healthy Behavior

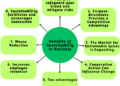

Insurance policies that reward healthy behavior come in various types, each offering unique incentives and benefits for policyholders.

1. Wellness Incentive Programs

- These programs encourage policyholders to engage in healthy activities such as exercise, regular check-ups, and preventive screenings.

- Policyholders can earn rewards like discounts on premiums, cashback, or gift cards for meeting specific health goals.

- Insurance companies benefit by reducing claims costs and promoting overall well-being among their customers.

2. Usage-Based Insurance (UBI)

- UBI policies track policyholders' behaviors, such as driving habits, physical activity, or diet, using technology like telematics devices or mobile apps.

- Policyholders who demonstrate safe or healthy behaviors can receive discounts on premiums or other rewards for maintaining good habits.

- Insurance companies benefit from reduced risk exposure and more accurate pricing based on individual behavior.

3. Health Savings Accounts (HSAs)

- HSAs combine high-deductible health plans with a savings account that policyholders can use to pay for medical expenses.

- Policyholders who maintain healthy behaviors and save money in their HSAs can enjoy tax benefits and lower premiums.

- Insurance companies benefit from lower claims costs and increased policyholder engagement in managing their health.

Examples of Rewards Offered

Insurance policies that reward healthy behavior often offer a variety of incentives to encourage individuals to make positive lifestyle choices. These rewards can range from financial incentives to discounts on premiums, as well as non-monetary rewards that promote overall well-being.

Discounts on Premiums

- Many insurance policies offer discounts on premiums for policyholders who engage in healthy behaviors such as regular exercise, maintaining a healthy weight, and quitting smoking.

- Policyholders may be required to track their progress through fitness apps or wellness programs to qualify for these discounts.

Financial Incentives

- Some insurance companies provide cash rewards or gift cards to policyholders who meet certain health goals, such as lowering their cholesterol levels or reducing their blood pressure.

- These financial incentives can serve as a motivating factor for individuals to adopt healthier habits and stick to their wellness plans.

Wellness Rewards

- Insurance policies may also offer wellness rewards in the form of gym memberships, fitness equipment, or healthy meal delivery services to policyholders who actively participate in wellness programs.

- These rewards not only promote healthy behaviors but also make it easier for individuals to access resources that support their overall well-being.

Tracking Healthy Behavior

Insurance policies that reward healthy behavior often monitor and track various activities of policyholders to assess their lifestyle choices and health habits. This information is crucial in determining the level of risk associated with insuring an individual and can lead to potential discounts or incentives for healthier behaviors.

Methods of Tracking

- Physical Activity Monitoring: Some insurance policies utilize wearable devices or smartphone apps to track the policyholder's physical activity levels, such as steps taken, distance traveled, or active minutes.

- Health Surveys: Policyholders may be required to complete health surveys periodically to provide information on their diet, exercise routines, and overall lifestyle choices.

- Biometric Data Collection: Insurance companies may collect biometric data like blood pressure, cholesterol levels, or body mass index (BMI) to assess the policyholder's health status.

Privacy Concerns

- Data Security: There are concerns about the security of the data collected, as it may include sensitive information about an individual's health and lifestyle choices. Insurance companies must ensure that this data is kept secure and confidential.

- Informed Consent: Policyholders should be informed about the types of data being collected, how it will be used, and have the option to provide consent or opt-out of data tracking if they have concerns about privacy.

- Data Sharing: There is also a concern about how insurance companies share and use the data collected on policyholders. It is essential for individuals to understand who has access to their information and how it is being utilized.

Impact on Premiums

Engaging in healthy behaviors can have a significant impact on insurance premiums, as insurance companies often offer discounts or rewards to policyholders who demonstrate healthy habits. These discounts are typically aimed at encouraging individuals to maintain good health and reduce the risk of filing claims.

Financial Benefits

- Policyholders who actively track and improve their health metrics, such as maintaining a healthy weight, exercising regularly, or quitting smoking, may qualify for lower premiums.

- Insurance companies view these individuals as lower risk, leading to potential savings on policy costs due to reduced likelihood of health-related claims.

- By incentivizing healthy behavior, insurance companies can create a win-win situation where policyholders benefit from improved health outcomes and lower premiums, while insurers benefit from reduced claim payouts.

Long-Term Savings

- Over time, maintaining healthy habits can result in long-term cost savings for policyholders, as they may continue to qualify for discounted premiums based on their sustained healthy behaviors.

- These cost savings can add up significantly over the years, providing an added financial incentive for individuals to prioritize their health and well-being.

- Furthermore, policyholders who remain healthy are less likely to require expensive medical treatments or interventions, leading to overall lower healthcare costs and insurance premiums.

Technology and Health Incentives

In today's digital age, technology plays a crucial role in incentivizing policyholders to adopt healthier lifestyles and promoting overall well-being. Through the use of wearables and mobile apps, insurance companies can track healthy behaviors and offer rewards to policyholders who demonstrate positive habits.

Role of Wearables and Apps

- Wearables such as fitness trackers and smartwatches can monitor physical activity, heart rate, sleep patterns, and other health metrics in real-time.

- Mobile apps can track diet, exercise routines, and even mental well-being through mood tracking and meditation features.

- By collecting and analyzing this data, insurance companies gain insights into the policyholder's lifestyle choices and can provide personalized recommendations for improvement.

Digital Tools for Incentivizing Healthy Behavior

- Insurance policies often offer discounts, cash rewards, or lower premiums to policyholders who achieve health goals or maintain healthy habits.

- Digital tools can gamify the process by setting challenges, sending reminders, and offering virtual rewards for meeting milestones.

- Policyholders are motivated to stay active and make healthier choices knowing that their efforts will be rewarded by their insurance provider.

Integration of Technology in Insurance Policies

- Insurance companies are increasingly integrating technology into their policies to promote overall well-being and prevent health issues before they arise.

- Some insurers offer wellness programs that include access to fitness classes, nutrition counseling, and telehealth services through digital platforms.

- By leveraging technology, insurance companies can not only reduce healthcare costs but also improve the quality of life for their policyholders.

Wrap-Up

In conclusion, Insurance Policies That Reward Healthy Behavior are not only beneficial for policyholders but also for insurance companies seeking to promote wellness. By incentivizing positive lifestyle choices, these policies are paving the way for a healthier future for all involved.

Popular Questions

How do insurance policies track healthy behaviors?

Insurance policies track healthy behaviors through various methods such as wearable devices, apps, and self-reporting by policyholders.

Do these policies lead to cost savings for policyholders?

Engaging in healthy behaviors can potentially lead to lower insurance premiums, resulting in cost savings for policyholders in the long run.

What are some examples of rewards offered by these policies?

Examples of rewards include premium discounts, cashback incentives, and gift cards for maintaining healthy habits.