Embark on a journey into the realm of Holistic Lifestyle Plans with Financial Coverage, where well-being and financial security intertwine to create a harmonious lifestyle. This guide delves into the essence of holistic living and the crucial role of financial coverage in achieving overall wellness.

Exploring the components of holistic lifestyle plans and the strategies to integrate financial stability, this narrative aims to provide valuable insights for a balanced and fulfilling life.

Holistic Lifestyle Plans

Holistic lifestyle plans focus on integrating various aspects of well-being, including physical, mental, emotional, and spiritual health, to achieve overall harmony and balance in life.

Benefits of Holistic Lifestyle

- Promotes overall well-being and balance

- Reduces stress and anxiety levels

- Boosts energy and vitality

- Enhances mental clarity and focus

Components of Holistic Lifestyle Plans

A holistic lifestyle plan typically includes:

- Physical Well-being:Regular exercise, balanced nutrition, and adequate rest.

- Mental Well-being:Mindfulness practices, meditation, and stress management techniques.

- Emotional Well-being:Expressing emotions, building healthy relationships, and practicing gratitude.

- Spiritual Well-being:Connecting with nature, exploring personal beliefs, and engaging in spiritual practices.

Holistic Practices in Lifestyle Plans

Examples of holistic practices that can be included in a lifestyle plan:

- Yoga and tai chi for physical and mental well-being

- Mindful eating for improved digestion and overall health

- Journaling for emotional release and self-reflection

- Meditation and breathwork for stress reduction and relaxation

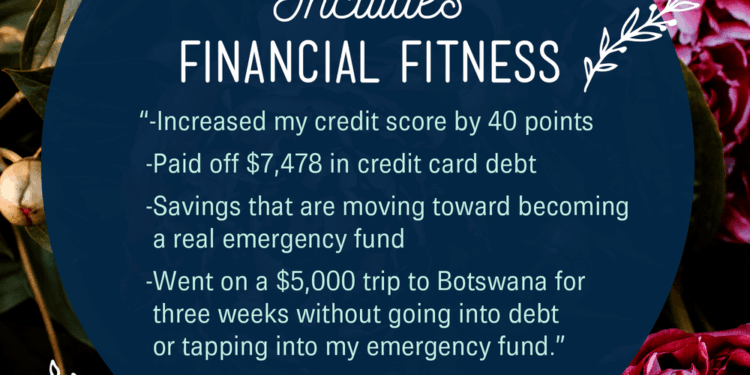

Financial Coverage in Holistic Lifestyle Plans

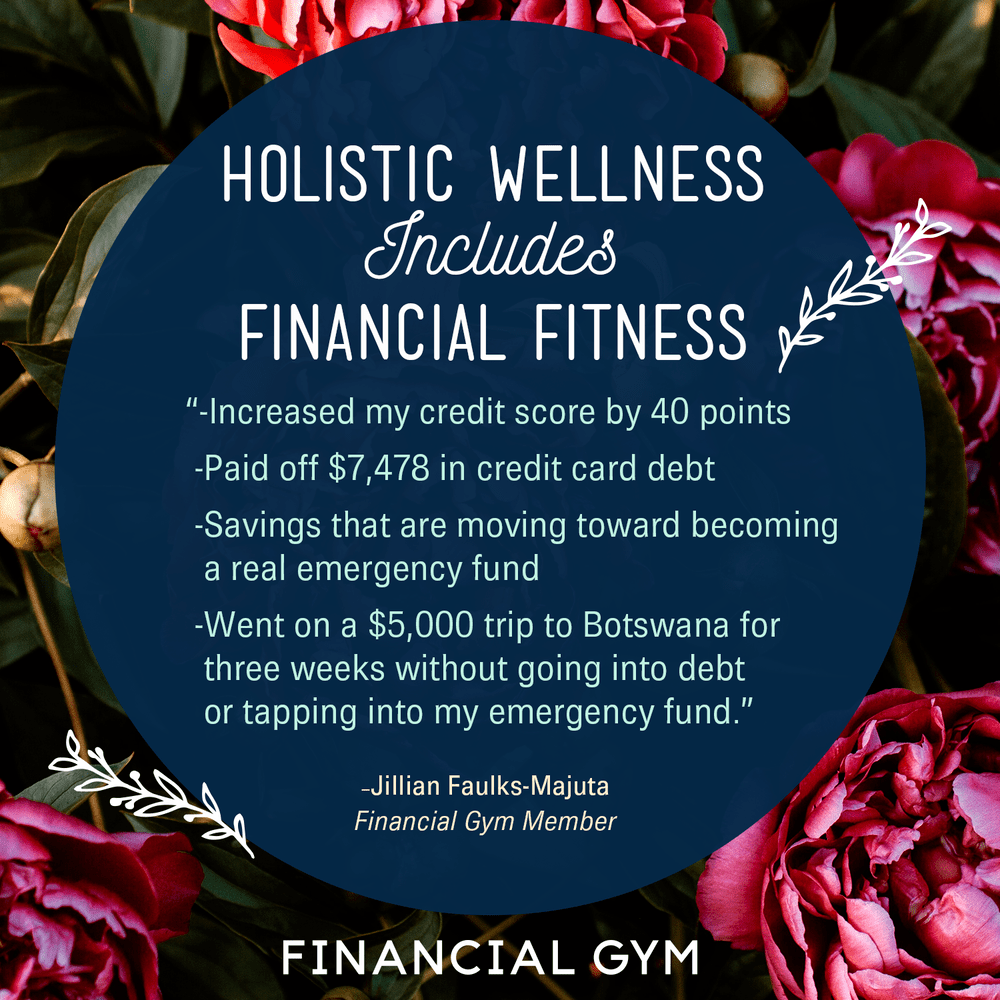

Financial coverage is a crucial component of a holistic lifestyle plan as it plays a significant role in overall well-being. When financial stability is achieved, individuals can experience reduced stress, improved mental health, and a sense of security.

The Importance of Financial Stability

Financial stability contributes to overall well-being by providing a sense of security and peace of mind. It allows individuals to focus on their health and wellness without the added stress of financial burdens.

Strategies for Integrating Financial Planning

- Include budgeting for healthy food choices and exercise-related expenses in your financial plan.

- Set financial goals that align with your holistic lifestyle objectives, such as saving for wellness retreats or gym memberships.

- Consider investing in insurance coverage for health-related expenses to minimize financial stress during emergencies.

Impact of Financial Stress on Health and Wellness

Financial stress can have a detrimental effect on health and wellness. It can lead to increased anxiety, depression, and even physical health problems such as heart disease and high blood pressure. Managing financial stress is essential for maintaining a holistic approach to well-being.

Implementing Holistic Lifestyle Plans with Financial Coverage

Creating a holistic lifestyle plan that incorporates financial goals and budgeting is essential for achieving overall well-being. Here are some steps to help you personalize your holistic lifestyle plan and maintain a balance between holistic practices and financial responsibilities.

Creating a Personalized Holistic Lifestyle Plan

- Assess your current lifestyle: Take stock of your physical, mental, emotional, and spiritual well-being to identify areas for improvement.

- Set holistic goals: Determine what areas of your life you want to focus on, such as nutrition, exercise, stress management, and relationships.

- Develop a plan: Create a detailed roadmap outlining specific actions you will take to achieve your holistic goals.

- Seek professional guidance: Consult with holistic health practitioners, nutritionists, therapists, or coaches to tailor a plan that meets your individual needs.

Incorporating Financial Goals and Budgeting

- Identify financial priorities: Determine your short-term and long-term financial goals, such as saving for emergencies, retirement, or major purchases.

- Create a budget: Establish a financial plan that aligns with your holistic goals, ensuring that you allocate funds for health-related expenses, self-care activities, and personal development.

- Track your spending: Monitor your expenses regularly to stay within your budget and make adjustments as needed to support your holistic lifestyle.

Maintaining Balance Between Holistic Practices and Financial Responsibilities

- Prioritize self-care: Allocate time and resources for activities that nurture your mind, body, and spirit without overspending.

- Practice mindfulness: Be conscious of your spending habits and make mindful choices that support your holistic well-being and financial health.

- Find affordable holistic alternatives: Explore cost-effective ways to incorporate holistic practices into your lifestyle, such as DIY home remedies, outdoor activities, or community resources.

Role of Professional Guidance

- Consult with financial advisors: Seek advice from financial experts to help you align your holistic lifestyle goals with your financial plan and make informed decisions.

- Work with holistic practitioners: Collaborate with holistic health professionals to integrate financial wellness into your overall well-being strategy and address any financial stressors that may impact your health.

- Regularly review and adjust: Schedule regular check-ins with both financial and holistic health professionals to assess your progress, make necessary adjustments, and stay on track towards achieving your goals.

Outcome Summary

In conclusion, Holistic Lifestyle Plans with Financial Coverage offer a roadmap to holistic well-being and financial security. By understanding the importance of both aspects and implementing personalized strategies, individuals can embark on a journey towards a more enriched and harmonious lifestyle.

Top FAQs

What is the significance of financial coverage in holistic lifestyle plans?

Financial coverage ensures that individuals have the resources to support their holistic well-being, covering aspects like healthcare, self-care practices, and personal development.

How can financial planning be integrated into a holistic lifestyle?

By setting clear financial goals aligned with holistic values, individuals can prioritize their well-being while ensuring financial stability for the future.

What role does professional guidance play in implementing holistic lifestyle plans with financial coverage?

Professional guidance can offer personalized insights and strategies to help individuals navigate the complexities of holistic living and financial management effectively.