Embark on a journey exploring the realm of Low-Risk Lifestyle Choices and Coverage Benefits, where the path to a healthier and secure future is unveiled through insightful discussions and practical insights.

Delve into the realm of healthy living and insurance coverage, discovering the intertwined relationship between lifestyle choices and financial protection.

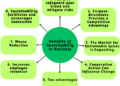

Benefits of Low-Risk Lifestyle Choices

Making low-risk lifestyle choices can have a multitude of benefits for your health and overall well-being. By incorporating these choices into your daily routine, you can significantly improve your quality of life and reduce the risk of various health issues.

Examples of Low-Risk Lifestyle Choices

- Eating a balanced diet rich in fruits, vegetables, and lean proteins.

- Regular exercise, such as walking, jogging, or yoga, at least 30 minutes a day.

- Avoiding smoking and excessive alcohol consumption.

- Getting an adequate amount of sleep each night, typically 7-9 hours for adults.

- Managing stress through techniques like meditation, deep breathing, or hobbies.

By adopting these low-risk lifestyle choices, you can improve your overall health and well-being in various ways.

Coverage Benefits of Low-Risk Lifestyle Choices

Maintaining a low-risk lifestyle can have significant implications on insurance coverage and premiums. Individuals who make healthy choices and engage in safe behaviors often enjoy more favorable terms when it comes to insurance policies compared to those with high-risk lifestyles.

Influence on Insurance Coverage

- Low-risk lifestyle choices such as regular exercise, a balanced diet, and avoiding harmful habits like smoking can lead to lower health insurance premiums. Insurers may offer discounts or lower rates to individuals who demonstrate a commitment to their well-being.

- Safe driving habits, adherence to traffic laws, and a clean driving record can result in lower auto insurance premiums. Insurers view cautious drivers as less likely to be involved in accidents, thus reducing the risk for the insurance company.

- Home insurance policies may also be affected by lifestyle choices. Maintaining a secure home environment, such as installing security systems and smoke detectors, can lead to reduced premiums as it lowers the risk of theft or property damage.

Comparison of Coverage Benefits

- Individuals with low-risk lifestyles are more likely to receive better coverage terms, higher coverage limits, and lower deductibles compared to those with high-risk lifestyles. Insurers see them as less likely to file claims, leading to more favorable terms.

- High-risk individuals may face exclusions or limitations in their coverage, higher deductibles, and increased premiums due to the elevated risk they present to insurance companies. This can result in higher out-of-pocket costs and reduced protection.

Variation in Insurance Premiums

- Insurance premiums are often tailored to the individual's level of risk. Those with low-risk lifestyles typically pay lower premiums due to the reduced likelihood of needing to file a claim. Insurers reward healthy and safe behaviors with more affordable coverage options.

- Conversely, individuals with high-risk lifestyles may face higher premiums to offset the increased probability of claims. Risky behaviors such as smoking, excessive drinking, or dangerous hobbies can result in elevated insurance costs to compensate for the added risk.

Importance of Regular Health Screenings

Regular health screenings play a crucial role in maintaining a low-risk lifestyle by allowing individuals to detect potential health issues early on, leading to better treatment outcomes and overall well-being.

Common Health Screenings

- Annual physical exams: These help monitor overall health and detect any abnormalities.

- Blood pressure checks: High blood pressure can lead to serious health issues if left untreated.

- Cholesterol tests: High cholesterol levels can increase the risk of heart disease and stroke.

- Mammograms and Pap smears: Important for early detection of breast and cervical cancer in women.

- Colonoscopies: Recommended for individuals over a certain age to screen for colorectal cancer.

Impact on Coverage Benefits

Regular health screenings can have a positive impact on coverage benefits by potentially reducing healthcare costs in the long run

By staying proactive about one's health and undergoing recommended screenings, individuals can not only improve their well-being but also maximize the benefits of their insurance coverage.

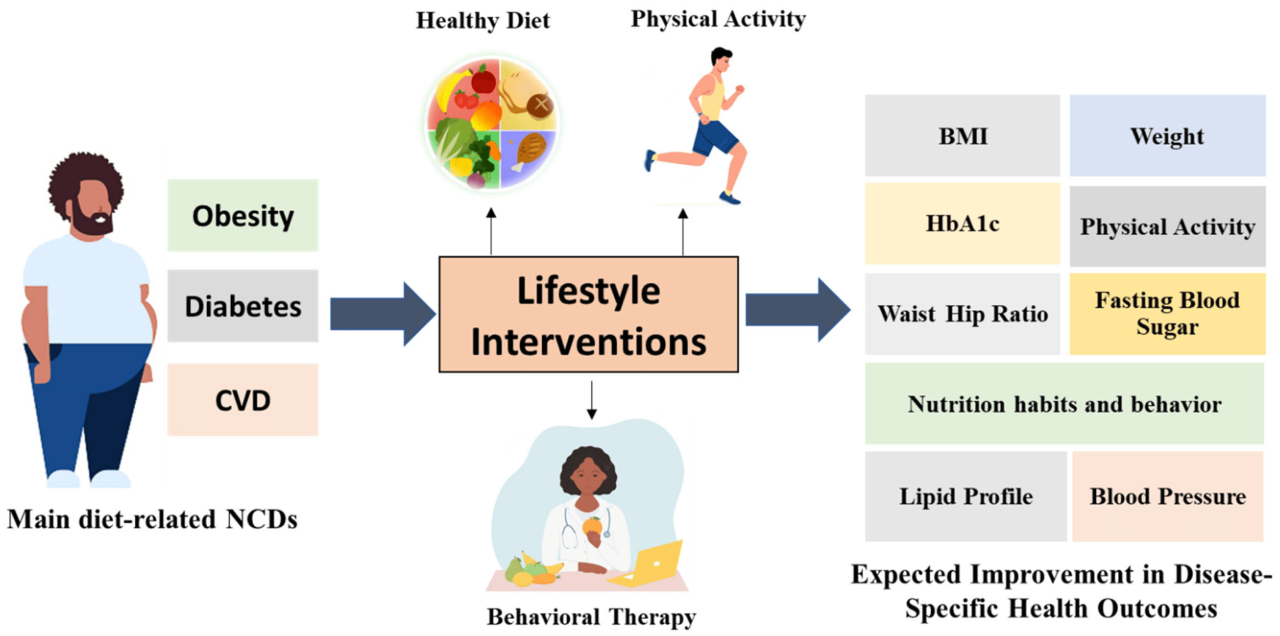

Healthy Diet and Exercise Regimens

Adopting a healthy diet and regular exercise regimen plays a crucial role in reducing health risks and maximizing coverage benefits. By focusing on nutritious food choices and physical activity, individuals can significantly enhance their overall well-being.

The Role of a Healthy Diet

A healthy diet rich in fruits, vegetables, whole grains, lean proteins, and healthy fats can help lower the risk of chronic diseases such as heart disease, diabetes, and obesity. Consuming a balanced diet provides essential nutrients that support the immune system and promote overall health.

The Importance of Regular Exercise

Regular exercise not only helps in maintaining a healthy weight but also reduces the risk of various health conditions. Physical activity boosts cardiovascular health, strengthens muscles, and improves mental well-being. Incorporating exercise into daily routines is essential for achieving a low-risk lifestyle.

Tips for Incorporating Healthy Choices

- Plan meals ahead of time to ensure balanced nutrition.

- Choose whole foods over processed options for better nutrient intake.

- Engage in different forms of physical activity such as walking, running, yoga, or swimming.

- Set realistic goals and gradually increase the intensity of workouts for sustainable progress.

- Stay hydrated throughout the day and prioritize sleep for overall well-being.

Stress Management and Mental Health Support

Stress management techniques and mental health support play a crucial role in maintaining a low-risk lifestyle and overall well-being. By effectively managing stress and seeking proper mental health support, individuals can improve their quality of life and reduce the risk of various health issues.

Benefits of Stress Management Techniques

- Regular exercise: Engaging in physical activity helps reduce stress levels by releasing endorphins, also known as "feel-good" hormones.

- Mindfulness and meditation: Practicing mindfulness techniques and meditation can help individuals stay present and calm, reducing anxiety and stress.

- Healthy sleep habits: Prioritizing quality sleep can improve mood, cognitive function, and stress management.

Impact of Mental Health Support

- Access to therapy and counseling: Seeking professional help can provide individuals with coping strategies, emotional support, and tools to manage stress effectively.

- Support groups: Connecting with others who are facing similar challenges can reduce feelings of isolation and provide a sense of community and understanding.

- Medication management: For individuals with mental health conditions, proper medication management under the guidance of a healthcare provider can significantly improve symptoms and overall well-being.

Strategies for Maintaining Mental Wellness

- Establishing healthy boundaries: Setting boundaries in personal and professional relationships can help reduce stress and prevent burnout.

- Practicing self-care: Engaging in activities that bring joy and relaxation, such as hobbies, spending time with loved ones, or pursuing interests, can promote mental wellness.

- Seeking help when needed: Recognizing the signs of stress or mental health concerns and reaching out for support from healthcare professionals, therapists, or support groups is essential for maintaining mental well-being.

Conclusion

In conclusion, Low-Risk Lifestyle Choices and Coverage Benefits offer a roadmap to a life filled with vitality and peace of mind, highlighting the importance of conscious decisions in shaping one's well-being and financial security.

Commonly Asked Questions

How do low-risk lifestyle choices impact insurance coverage?

Low-risk lifestyle choices can lead to lower insurance premiums and better coverage options due to reduced health risks.

What are some examples of low-risk lifestyle choices?

Examples include regular exercise, balanced diet, stress management, and avoiding harmful habits like smoking.

Why are regular health screenings important for maintaining a low-risk lifestyle?

Regular screenings help in early detection of health issues, leading to better coverage benefits and improved overall well-being.