As Flexible Lifestyle Insurance for Freelancers takes center stage, this opening passage beckons readers with an engaging overview of the topic, setting the stage for an informative discussion on the importance of tailored insurance solutions for freelancers.

Exploring the nuances of flexible lifestyle insurance and how it differs from traditional options, this paragraph offers a glimpse into the unique benefits it provides to freelancers seeking financial security in an ever-changing landscape.

Overview of Flexible Lifestyle Insurance for Freelancers

Flexible lifestyle insurance for freelancers is a type of insurance specifically designed to meet the unique needs of individuals who work as independent contractors or self-employed professionals. Unlike traditional insurance options, flexible lifestyle insurance offers customizable coverage that can adapt to the changing circumstances of freelancers.

Importance of Having Insurance Tailored for Freelancers

Freelancers often face fluctuating income, irregular work schedules, and varying project durations, making it essential to have insurance that can provide financial protection in times of need. Traditional insurance plans may not offer the flexibility required by freelancers, hence the importance of having insurance tailored to their specific lifestyle and work situation.

How Flexible Lifestyle Insurance Differs from Traditional Insurance Options

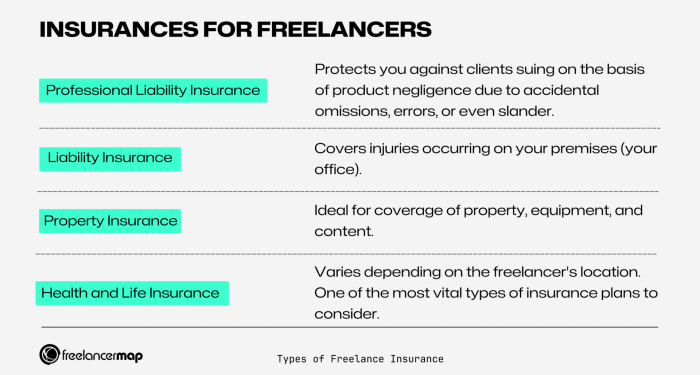

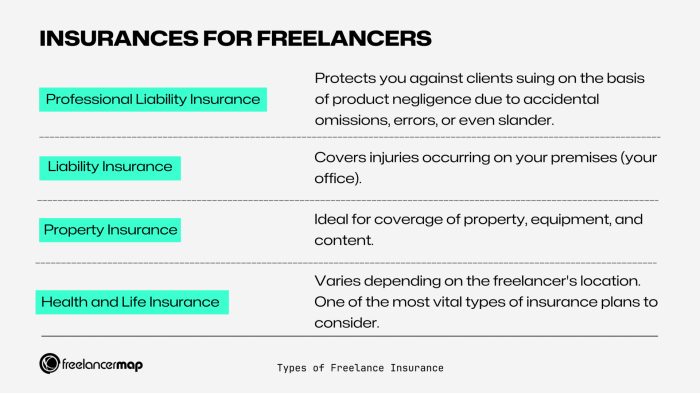

- Customizable Coverage: Flexible lifestyle insurance allows freelancers to choose the type and level of coverage that best fits their unique needs, unlike traditional insurance plans with fixed coverage options.

- Adaptable Premiums: Freelancers can adjust their premiums based on their income fluctuations, ensuring that they can maintain coverage even during lean months.

- Additional Benefits: Flexible lifestyle insurance may offer additional benefits tailored to freelancers, such as coverage for equipment, liability protection for client lawsuits, or coverage for project interruptions.

- Portability: Freelancers who often work remotely or travel for work can benefit from insurance that is portable and can provide coverage across different locations or countries.

Factors to Consider When Choosing Flexible Lifestyle Insurance

When selecting flexible lifestyle insurance as a freelancer, there are several key factors that should be taken into consideration to ensure that the coverage meets your individual needs and provides the necessary protection for your lifestyle and work.One important factor to consider is the customization of coverage options.

As a freelancer, your insurance needs may differ from traditional employees, so having the ability to tailor your coverage to suit your specific circumstances is essential. This could include options for coverage related to your work, equipment, liability, or health, depending on your line of work and personal situation.

Flexibility in Premium Payments

- One important aspect to consider is the flexibility in premium payments. As a freelancer, your income may fluctuate, so having the option to adjust your premium payments based on your earnings can be crucial.

- Some insurance providers offer payment plans that allow you to pay premiums on a monthly, quarterly, or annual basis, giving you the flexibility to choose a payment schedule that aligns with your financial situation.

- Additionally, look for insurance providers that offer grace periods or flexible payment options in case you experience temporary financial difficulties, ensuring that your coverage remains intact even during challenging times.

Benefits of Flexible Lifestyle Insurance for Freelancers

Flexible lifestyle insurance offers a range of benefits tailored to the unique needs of freelancers, providing them with the financial security they require in an ever-changing work environment.

Adaptable Coverage

One major advantage of flexible lifestyle insurance is its ability to adapt to a freelancer's changing circumstances. As freelancers often experience fluctuations in income and workload, having insurance that can be adjusted accordingly ensures that they are always adequately covered

Financial Security

During uncertain times, such as periods of illness or unexpected emergencies, flexible insurance can provide freelancers with the financial security they need to weather the storm. It offers a safety net that allows freelancers to focus on their work without worrying about financial setbacks.

Tailored Protection

Flexible lifestyle insurance can be customized to meet the specific needs of freelancers in various industries. For example, a freelance graphic designer may require coverage for damage to equipment, while a freelance writer may need liability insurance for potential copyright issues.

Tailored coverage ensures that freelancers are protected in areas that are most relevant to their work.

Case Studies or Success Stories

In this section, we will explore real-life examples of freelancers who have benefitted from flexible lifestyle insurance and how having the right insurance plan positively impacted their lives and businesses.

Case Study 1: Sarah, Graphic Designer

Sarah, a freelance graphic designer, was struggling to manage her finances due to unpredictable income streams. She decided to opt for a flexible lifestyle insurance plan that offered coverage tailored to her needs. With this plan, Sarah was able to receive financial support during periods of low income, allowing her to focus on her work without worrying about financial stability.

This adjustment in her insurance coverage provided Sarah with peace of mind and security, ultimately boosting her productivity and creativity in her freelance business.

Case Study 2: Alex, Content Writer

Alex, a freelance content writer, faced a medical emergency that required him to take time off work. His flexible lifestyle insurance plan included coverage for medical expenses and disability benefits, which supported him during his recovery period. This insurance adjustment not only helped Alex cover his medical bills but also ensured that his income was protected while he was unable to work.

As a result, Alex was able to focus on his health without worrying about financial strain, highlighting the significant impact of the right insurance plan on freelancers' well-being and livelihood.

Final Summary

In conclusion, the discussion on Flexible Lifestyle Insurance for Freelancers highlights the necessity of customizable insurance solutions in empowering freelancers to navigate uncertain times with confidence. By adapting to their evolving needs and circumstances, flexible insurance can truly make a difference in safeguarding their livelihoods and businesses.

Essential FAQs

What is flexible lifestyle insurance tailored for freelancers?

Flexible lifestyle insurance is a customized insurance solution designed specifically to meet the unique needs and circumstances of freelancers, offering tailored coverage options that traditional insurance may not provide.

How can coverage options be customized for individual freelancer needs?

Freelancers can customize their coverage options by selecting specific benefits, adjusting coverage limits, and tailoring their policy to suit their changing circumstances and financial goals.

Why is it important for freelancers to have insurance that adapts to changing circumstances?

Having insurance that adapts to changing circumstances is crucial for freelancers as it ensures financial security during unpredictable times and provides peace of mind knowing that their livelihood is protected.