Healthy Living Habits That Reduce Insurance Costs sets the stage for this informative piece, diving into the crucial relationship between health habits and financial savings. This discussion sheds light on the importance of maintaining a healthy lifestyle not just for well-being but also for reducing insurance expenses.

As we delve deeper into specific examples of healthy habits, their impact on insurance costs, and strategies to incorporate them, readers will gain valuable insights on how to lead a healthier life while saving money on insurance premiums.

Importance of Healthy Living Habits

Maintaining healthy living habits is crucial for overall well-being as it directly impacts our physical, mental, and emotional health. By adopting healthy habits such as regular exercise, balanced nutrition, and adequate sleep, individuals can significantly improve their quality of life.

Contributing to a Better Quality of Life

- Regular exercise helps in maintaining a healthy weight, strengthening muscles, and improving cardiovascular health.

- Eating a balanced diet rich in fruits, vegetables, whole grains, and lean proteins provides essential nutrients for overall health.

- Getting enough sleep is important for proper brain function, emotional well-being, and overall productivity.

Impact on Reducing Insurance Costs

- Healthy individuals are less likely to develop chronic diseases such as diabetes, heart disease, and certain types of cancer, leading to lower healthcare costs.

- Insurance companies often offer discounts or lower premiums to individuals who demonstrate healthy living habits through regular exercise, healthy eating, and preventive care.

- By prioritizing health and wellness, individuals can reduce the risk of costly medical procedures and long-term healthcare expenses.

Examples of Healthy Living Habits

Regular exercise and a balanced diet are key components of maintaining a healthy lifestyle. Exercise helps improve cardiovascular health, strengthen muscles, and boost overall well-being. A balanced diet rich in fruits, vegetables, whole grains, and lean proteins provides essential nutrients for optimal body function.

The Significance of Sufficient Sleep

Getting an adequate amount of sleep is crucial for overall health. Lack of sleep can lead to a weakened immune system, increased risk of chronic diseases, and impaired cognitive function. Aim for 7-9 hours of quality sleep each night to support your body's natural healing and repair processes.

Stress Management

Chronic stress can have detrimental effects on both physical and mental health. Implementing stress management techniques such as mindfulness, meditation, exercise, and spending time in nature can help reduce stress levels and improve overall well-being.

Preventive Care and Regular Check-ups

Regular check-ups with healthcare providers for preventive care can help detect potential health issues early on, allowing for timely intervention and treatment. By staying proactive with preventive care, you can potentially avoid more serious health complications in the future, leading to cost savings on insurance by preventing costly medical procedures.

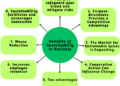

Relationship Between Healthy Living Habits and Insurance Costs

Maintaining healthy living habits can have a significant impact on insurance costs, as it directly influences the risk of chronic diseases and overall well-being. By adopting a healthy lifestyle, individuals can reduce the likelihood of developing health conditions that may require costly medical treatments, ultimately leading to lower insurance premiums.

Lower Risk of Chronic Diseases

Healthy behaviors such as regular exercise, balanced diet, adequate sleep, and stress management can help lower the risk of chronic diseases such as heart disease, diabetes, and obesity. Insurance companies take into account the individual's health status when calculating premiums, and those with healthier habits are deemed less risky to insure.

Comparison of Insurance Costs

Individuals with healthy living habits typically pay lower insurance premiums compared to those with unhealthy lifestyles. This is because healthier individuals are less likely to make frequent claims for medical treatments or hospitalizations, resulting in reduced overall costs for insurance companies.

Incentivizing Healthy Living Habits

Insurance companies often offer incentives to policyholders who adopt healthy behaviors, such as discounts on premiums, cash rewards, or access to wellness programs

Strategies to Incorporate Healthy Habits

Incorporating healthy habits into daily routines is essential for long-term well-being and reducing insurance costs. By making small but consistent changes, individuals can improve their overall health and financial outlook. Here are some strategies to help integrate healthy habits into daily life:

Design a Plan for Integrating Healthy Habits

Creating a structured plan is crucial for successfully incorporating healthy habits into daily routines. Start by identifying specific areas where improvements can be made, such as increasing physical activity, improving diet, reducing stress, or getting enough sleep. Set realistic goals and create a timeline for achieving them.

Consider seeking guidance from a healthcare professional or a wellness coach to develop a personalized plan tailored to individual needs.

Organize Tips for Staying Motivated

Maintaining motivation is key to sustaining healthy behaviors long-term. Find activities that are enjoyable and make them a regular part of your routine. Surround yourself with a supportive community or accountability partner to stay on track. Celebrate small victories along the way and track progress to stay motivated.

Remember that consistency is more important than perfection, and it's okay to have setbacks as long as you continue to strive for improvement.

Create a Guide on Setting Achievable Health Goals

Setting achievable health goals is essential for positively impacting insurance costs. Start by identifying specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, aim to exercise for 30 minutes five days a week, or to incorporate more fruits and vegetables into your daily meals.

Break down larger goals into smaller, manageable steps to ensure success. Regularly review and adjust goals as needed to stay on track and continue making progress towards better health and reduced insurance costs.

End of Discussion

In conclusion, adopting Healthy Living Habits That Reduce Insurance Costs is not only beneficial for your health but also for your wallet. By making small changes to your daily routine and prioritizing preventive care, you can enjoy a healthier life while cutting down on insurance expenses.

This guide serves as a roadmap to achieving both physical well-being and financial savings through simple yet impactful lifestyle choices.

Query Resolution

How do healthy habits impact insurance costs?

Healthy habits reduce the risk of chronic diseases, leading to lower insurance premiums.

What are some examples of healthy living habits?

Examples include regular exercise, balanced diet, sufficient sleep, and stress management.

Why do insurance companies incentivize healthy living habits?

Insurance companies incentivize to reduce the likelihood of claims and promote overall well-being.