Exploring the intricate connection between your lifestyle choices and insurance premiums unveils a fascinating narrative that sheds light on the various factors at play. From your occupation to travel habits, each aspect plays a crucial role in determining the cost of your insurance coverage.

Delving deeper into this topic, we will uncover how factors like age, health, and even travel destinations can significantly impact the premiums you pay for insurance.

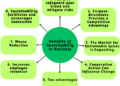

Factors affecting insurance premiums

Insurance premiums are influenced by a variety of lifestyle factors that insurers take into consideration when determining the cost of coverage.

Age

Age is a significant factor that impacts insurance premiums. Younger individuals typically pay lower premiums as they are considered to be healthier and less prone to health issues. On the other hand, older individuals are more likely to face health challenges, leading to higher insurance costs.

Occupation

Occupation can also affect insurance premiums. Individuals working in high-risk professions such as firefighters or construction workers may face higher premiums due to the increased likelihood of workplace injuries. On the other hand, individuals with desk jobs may pay lower premiums as they are perceived to have lower risks.

Health

Health plays a crucial role in determining insurance premiums. Individuals with pre-existing medical conditions may face higher premiums as they are considered to be at a higher risk of requiring medical care. Maintaining good health through regular exercise, a balanced diet, and routine check-ups can help lower insurance costs.

Lifestyle Choices

Your lifestyle choices, such as smoking, alcohol consumption, and participation in extreme sports, can impact insurance premiums. Smoking, for example, is associated with a higher risk of developing health issues, leading to increased premiums. Making healthier lifestyle choices can help reduce insurance costs.

Health and its impact on insurance

Maintaining good health is not only crucial for your overall well-being but also plays a significant role in determining your insurance premiums. Health insurance companies take into account various lifestyle choices and health conditions to assess the risk posed by an individual and calculate the corresponding premiums.

Lifestyle choices affecting health insurance premiums

- Smoking: Individuals who smoke are considered to be at a higher risk for various health conditions such as heart disease, lung cancer, and respiratory issues. As a result, smokers typically face higher insurance premiums compared to non-smokers.

- Diet: Poor dietary habits leading to obesity, diabetes, and other health issues can also impact insurance premiums. Maintaining a healthy diet and weight can help lower the risk of developing chronic conditions and consequently reduce insurance costs.

- Exercise: Regular physical activity is associated with better overall health and a lower risk of illnesses. Insurers may offer discounts or lower premiums to individuals who engage in regular exercise as they are less likely to make claims for medical treatment.

Comparison of insurance rates based on health conditions

- Individuals with pre-existing health conditions such as diabetes, high blood pressure, or cancer may face higher insurance premiums due to the increased likelihood of requiring medical care or treatments related to their condition.

- On the other hand, individuals with no significant health issues and a clean medical history are considered lower risk by insurance companies, leading to lower premiums for their coverage.

Benefits of maintaining a healthy lifestyle

- Lower insurance premiums: By making healthy lifestyle choices such as quitting smoking, eating a balanced diet, and staying active, individuals can reduce their risk of developing costly health conditions. This, in turn, can lead to lower insurance premiums as insurers perceive them as lower risk clients.

- Long-term cost savings: Investing in your health through preventive measures and healthy habits not only benefits you in terms of lower insurance costs but also reduces the need for expensive medical treatments in the future, ultimately saving you money in the long run.

Occupation and insurance premiums

When it comes to determining insurance premiums, one crucial factor that insurers take into consideration is the insured individual's occupation. This is because different professions pose varying levels of risk, which can impact the likelihood of filing a claim and the potential costs involved.

Impact of occupation on insurance costs

- High-risk occupations, such as firefighters, police officers, and construction workers, are typically associated with higher insurance premiums. This is due to the increased likelihood of workplace injuries or accidents in these professions.

- On the other hand, individuals working in low-risk occupations, such as office workers or teachers, may qualify for lower insurance premiums as they are considered less likely to face occupational hazards.

- Some professions, like doctors or lawyers, may be eligible for discounts on their insurance premiums. This is because these individuals are perceived to have higher income levels and lower risk profiles, making them attractive customers for insurers.

Travel habits and insurance rates

Travel habits can have a significant impact on insurance premiums. Insurance companies take into account factors such as travel frequency and destinations when determining the cost of coverage. It is essential to understand how your travel habits can influence the rates you pay for insurance and why it is crucial to disclose this information accurately when applying for a policy.

Impact of travel frequency and destinations on insurance premiums

- Travel frequency: The more frequently you travel, especially to destinations with higher risk factors, the higher your insurance premiums are likely to be. This is because frequent travelers are seen as a higher risk for potential claims.

- Destinations: Traveling to certain destinations with a history of political instability, natural disasters, or high crime rates can result in increased insurance rates. Insurance companies consider the risk associated with the location when calculating premiums.

- Travel duration: The length of your trips can also affect insurance premiums. Longer trips may lead to higher premiums due to the extended exposure to potential risks.

Examples of how travel insurance rates may vary based on lifestyle choices

- Adventure travelers: Individuals who engage in high-risk activities such as extreme sports or adventure travel may face higher insurance premiums to account for the increased likelihood of injury or accidents.

- Frequent flyers: People who travel frequently for work or leisure may be charged higher premiums to cover the potential risks associated with regular travel, such as flight delays, cancellations, or medical emergencies abroad.

- Luxury travelers: Traveling in luxury or staying at high-end resorts can also impact insurance rates, as these accommodations may come with higher replacement costs in case of damage or loss.

Importance of disclosing travel habits when applying for insurance

- Accurate information: Providing truthful and detailed information about your travel habits ensures that you are adequately covered and that your claims will be processed smoothly in case of an emergency.

- Risk assessment: Insurance companies use your travel habits to assess the level of risk you pose as a policyholder. Failing to disclose relevant information can result in coverage gaps or even claim denials.

- Premium accuracy: By disclosing your travel habits upfront, you can ensure that your insurance premiums are accurately calculated based on the specific risks associated with your lifestyle choices.

Epilogue

In conclusion, understanding how your lifestyle influences insurance premiums is key to making informed decisions about your coverage. By making conscious choices and maintaining a healthy lifestyle, you can potentially lower your insurance costs and secure better financial protection for the future.

Question Bank

How does smoking affect health insurance premiums?

Smoking can lead to higher health insurance premiums due to the increased health risks associated with tobacco use. Insurers often charge more to cover these elevated risks.

Can my occupation impact my life insurance premiums?

Yes, certain occupations considered high-risk may lead to higher life insurance premiums. It's important to disclose your occupation accurately when applying for coverage.

Do travel habits affect insurance rates?

Yes, travel habits such as frequency and destinations can influence insurance rates, especially for travel insurance. It's crucial to provide accurate information about your travel habits to ensure proper coverage.