Embarking on the journey of Integrating Fitness into Long Life Insurance opens doors to a realm where well-being meets financial protection. This innovative approach not only benefits policyholders but also revolutionizes the insurance landscape by promoting a healthy lifestyle.

As we delve deeper, the discussion will unveil the transformative power of fitness incentives within insurance policies, shedding light on the myriad advantages awaiting those who embrace this holistic approach.

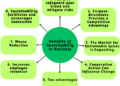

Benefits of Integrating Fitness into Long Life Insurance

Incorporating fitness into long life insurance policies can have numerous benefits for both policyholders and insurance companies. By promoting a healthier lifestyle, insurance companies can potentially reduce costs and improve the overall well-being of their clients.

Healthier Policyholders

Integrating fitness programs into insurance policies encourages policyholders to adopt healthier habits, such as regular exercise and balanced nutrition. This can lead to reduced risks of chronic diseases like heart disease, diabetes, and obesity. As a result, policyholders may experience improved overall health and longevity.

Cost Savings for Insurance Companies

Insurance companies can benefit from integrating fitness by potentially reducing the number of claims related to preventable health conditions. By incentivizing policyholders to engage in fitness activities, such as gym memberships or wellness programs, insurance companies can lower their overall healthcare costs.

Additionally, healthier policyholders may require fewer medical interventions, leading to decreased expenses for insurers.

Successful Fitness Programs

Some insurance companies have successfully integrated fitness programs into their policies by offering discounts or rewards for policyholders who meet certain fitness goals. For example, some policies provide premium discounts for individuals who regularly participate in fitness challenges or wellness screenings.

These initiatives not only promote physical activity but also create a sense of accountability among policyholders to maintain a healthy lifestyle.

Strategies for Implementing Fitness Incentives

Implementing fitness incentives in long life insurance policies can encourage policyholders to adopt healthier lifestyles, leading to reduced risks and better overall health outcomes. Let's explore different strategies to effectively integrate fitness incentives into insurance policies.

Types of Fitness Incentives

- Discounts on Premiums: Offer policyholders discounts on their insurance premiums based on their participation in fitness activities or achieving specific health goals.

- Rewards Programs: Implement rewards programs where policyholders earn points or rewards for engaging in fitness activities, which can be redeemed for various benefits.

- Gym Memberships: Provide discounted or free gym memberships to policyholders as an incentive to encourage regular exercise and physical activity.

- Wellness Challenges: Organize wellness challenges and competitions among policyholders to promote healthy behaviors and active lifestyles.

Tracking and Measuring Impact

- Health Assessments: Conduct regular health assessments to track policyholders' progress in fitness programs and measure improvements in health metrics.

- Data Analytics: Utilize data analytics to analyze the impact of fitness incentives on policyholders' health outcomes and identify trends for future program enhancements.

- Surveys and Feedback: Collect feedback from policyholders to understand their experiences with fitness incentives and make necessary adjustments to improve program effectiveness.

Role of Technology

- Wearable Devices: Encourage policyholders to use wearable devices to track their physical activity, monitor health metrics, and provide real-time feedback on their progress.

- Mobile Apps: Develop mobile apps that allow policyholders to set fitness goals, track their workouts, and participate in challenges to earn incentives.

- Telemedicine: Integrate telemedicine services to provide virtual consultations with healthcare professionals, offering guidance and support for policyholders' fitness journeys.

Challenges and Solutions

Integrating fitness into long life insurance can pose several challenges that need to be addressed in order to ensure successful implementation. These challenges may include lack of participation or motivation from policyholders, as well as resistance from insurance providers who may be hesitant to incorporate fitness incentives into their policies.

Lack of Participation and Motivation

One common challenge in integrating fitness into long life insurance is the lack of participation and motivation from policyholders. Many individuals may be reluctant to engage in fitness activities or adopt healthier lifestyles, which can hinder the effectiveness of such programs.

- Offering personalized fitness plans and tailored incentives based on individual goals and preferences can help increase participation among policyholders.

- Creating a supportive community or online platform where policyholders can connect, share their progress, and receive encouragement can also boost motivation.

- Providing regular feedback, rewards, and recognition for achieving fitness milestones can further incentivize policyholders to stay committed to their health and wellness goals.

Resistance from Policyholders and Insurance Providers

Another challenge that may arise is resistance from both policyholders and insurance providers. Policyholders may be skeptical about the benefits of integrating fitness into their insurance policies, while insurance providers may have concerns about the additional costs and administrative burden associated with implementing fitness incentives.

- Educating policyholders about the long-term benefits of leading a healthy lifestyle and the positive impact it can have on their overall well-being and longevity can help overcome resistance.

- Collaborating with insurance providers to streamline the integration of fitness programs, reduce administrative complexities, and ensure cost-effectiveness can address their concerns and encourage adoption of fitness incentives.

- Conducting pilot programs, collecting data on the effectiveness of fitness incentives, and sharing success stories and testimonials can demonstrate the value of integrating fitness into long life insurance and help alleviate doubts or skepticism.

Impact on Policyholder Behavior and Longevity

Fitness incentives integrated into long life insurance policies can have a significant impact on policyholders' behavior and overall longevity. By providing incentives for maintaining a healthy lifestyle, insurance companies can motivate individuals to make positive lifestyle choices that can lead to a longer and healthier life.

Correlation between Fitness Levels and Longevity

- Studies have shown a clear correlation between fitness levels and longevity among insurance policyholders.

- Policyholders who engage in regular physical activity and maintain a healthy weight are more likely to live longer and have a decreased risk of developing chronic diseases.

- Insurance companies can leverage this data to tailor fitness incentives that encourage policyholders to adopt healthier behaviors and reduce their risk of premature mortality.

Long-Term Benefits of Encouraging Healthy Behaviors

- Encouraging healthy behaviors through fitness incentives can lead to long-term benefits for both policyholders and insurance companies.

- Policyholders who engage in regular exercise, maintain a balanced diet, and manage stress effectively are less likely to require costly medical interventions in the future.

- Insurance companies can benefit from lower claim rates and increased customer loyalty by promoting and rewarding healthy behaviors among policyholders.

Final Review

In conclusion, Integrating Fitness into Long Life Insurance emerges as a beacon of hope for a healthier future. By intertwining fitness incentives with insurance coverage, individuals are not only safeguarding their well-being but also paving the way for a more sustainable and fulfilling life.

Clarifying Questions

How can fitness incentives impact policyholders' lifestyle choices?

Fitness incentives can motivate policyholders to adopt healthier habits like regular exercise and balanced nutrition, leading to improved overall well-being.

What role does technology play in implementing fitness incentives?

Technology enables the tracking and monitoring of fitness programs, providing insights into policyholders' engagement and progress towards health goals.

How do fitness programs contribute to long-term benefits through insurance policies?

By encouraging healthy behaviors, fitness programs can enhance policyholders' quality of life, reduce healthcare costs, and potentially increase longevity.