Embark on a journey towards financial security with Smart Habits for a Financially Secure Life. Discover the key practices that can pave the way for a stable and prosperous future, ensuring peace of mind and financial well-being.

Delve deeper into the realms of budgeting, tracking expenses, building emergency funds, and investing wisely as we explore the crucial aspects of securing your financial future.

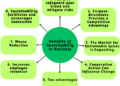

Importance of Smart Financial Habits

Smart financial habits play a crucial role in achieving a financially secure life by ensuring that individuals are able to effectively manage their finances, save for the future, and avoid unnecessary debt.

Key Smart Habits for Financial Security

- Creating and sticking to a budget: Establishing a budget helps individuals track their spending, identify areas where they can cut back, and allocate funds towards savings and investments.

- Building an emergency fund: Setting aside money for unexpected expenses can prevent individuals from going into debt during challenging times.

- Investing for the future: Investing early and consistently can help grow wealth over time and secure financial stability in the long run.

- Avoiding unnecessary debt: Being mindful of borrowing and only taking on debt when necessary can prevent financial strain and interest payments.

Impact of Good vs. Poor Financial Habits

Good financial habits, such as saving regularly, investing wisely, and living within one's means, can lead to financial stability, wealth accumulation, and peace of mind. On the other hand, poor financial habits like overspending, neglecting savings, and accumulating high-interest debt can result in financial stress, insecurity, and limited opportunities for growth.

Budgeting and Tracking Expenses

Budgeting and tracking expenses are essential components of managing personal finances effectively. By creating a budget and monitoring where your money goes, you can make informed decisions to achieve financial security.

Effective Budgeting Techniques

- Start by calculating your total monthly income from all sources.

- List all your fixed expenses, such as rent, utilities, and loan payments.

- Allocate a portion of your income to savings and investments.

- Track your variable expenses, like groceries and entertainment, and set limits for each category.

- Regularly review and adjust your budget to reflect changing financial circumstances.

Importance of Tracking Expenses

Tracking expenses allows you to understand where your money is going and identify areas where you can cut back or save more. It helps you avoid overspending, prioritize your financial goals, and stay on track with your budget.

Tools for Efficient Expense Tracking

- Personal Finance Apps:Apps like Mint, YNAB (You Need a Budget), and PocketGuard can help you track your expenses, set budgeting goals, and receive financial insights.

- Spreadsheets:Creating a simple Excel spreadsheet or using Google Sheets can also be effective for manually tracking expenses and budgeting.

- Receipt Scanning Apps:Apps like Expensify or Receipts by Wave allow you to scan and categorize receipts for easy expense tracking.

Building an Emergency Fund

Having an emergency fund is crucial for financial security as it provides a safety net during unexpected situations such as job loss, medical emergencies, or major home repairs. Without an emergency fund, individuals may be forced to rely on high-interest loans or credit cards, leading to debt and financial instability.

Significance of an Emergency Fund

Emergency funds should typically cover 3 to 6 months' worth of living expenses. To calculate the amount needed for your emergency fund, add up all essential expenses such as rent/mortgage, utilities, groceries, insurance, and debt payments. Multiply this total by the number of months you want to cover (e

Building a Plan for Your Emergency Fund

- Start by setting a realistic savings goal based on your monthly income and expenses. Aim to save a small percentage of your income each month towards your emergency fund.

- Automate your savings by setting up a direct deposit from your paycheck into a separate savings account dedicated to your emergency fund.

- Cut back on non-essential expenses to free up more money for savings. Consider creating a budget to track your spending and identify areas where you can reduce costs.

- Consider additional sources of income, such as freelance work or selling unused items, to boost your savings for emergencies.

- Monitor your progress regularly and adjust your savings plan as needed. Celebrate small milestones along the way to stay motivated.

Investing for the Future

Investing plays a crucial role in securing one's financial future by allowing your money to grow over time. It is a way to potentially increase your wealth and achieve long-term financial goals.

Types of Investments

- Stocks: Buying shares of ownership in a company, which can provide dividends and capital appreciation.

- Bonds: Loans made to governments or corporations in exchange for periodic interest payments.

- Mutual Funds: Pooled investments managed by professionals who invest in a diversified portfolio of securities.

- Real Estate: Investing in properties to generate rental income or capital appreciation.

Tips for Beginners

- Start with a clear investment goal and timeline.

- Understand your risk tolerance and choose investments that align with it.

- Diversify your investments to spread risks across different asset classes.

- Consider starting with low-cost index funds or ETFs for broad market exposure.

- Stay informed and continuously educate yourself about investing.

Ending Remarks

In conclusion, adopting smart financial habits is the cornerstone of a financially secure life. By implementing these practices, you pave the way for a prosperous future filled with financial stability and peace of mind. Start your journey towards financial freedom today!

FAQ Summary

How much should I save in an emergency fund?

It is recommended to save at least 3 to 6 months' worth of living expenses in your emergency fund to ensure financial security in case of unforeseen events.

What are some effective budgeting techniques?

Effective budgeting techniques include tracking your expenses, setting financial goals, creating a monthly budget, and reviewing your spending regularly to stay on track.

How do I start investing wisely as a beginner?

As a beginner, start by educating yourself about different investment options, setting clear financial goals, and seeking advice from financial experts or advisors to make informed investment decisions.