Diving into the realm of Sustainable Life Coverage with Long-Term Benefits, this introduction sets the stage for an enlightening journey into the world of insurance. With a focus on longevity and stability, this topic delves into the intricacies of securing a sustainable future through comprehensive coverage.

The following paragraphs will shed light on the nuances of sustainable life coverage, its benefits, key factors to consider, and the industry's sustainable practices that shape the landscape of insurance today.

Understanding Sustainable Life Coverage

Sustainable life coverage involves a life insurance policy that not only provides financial protection for the policyholder's loved ones in case of death but also focuses on long-term benefits that can support the insured individual during their lifetime.

The Importance of Long-Term Benefits in Life Insurance

Long-term benefits in life insurance are crucial as they offer more than just a death benefit. These benefits can include cash value accumulation, living benefits, and potential investment opportunities that can help the policyholder build wealth and secure their financial future.

How Sustainable Life Coverage Differs from Traditional Life Insurance

Unlike traditional life insurance policies that mainly focus on providing a death benefit, sustainable life coverage prioritizes the long-term financial well-being of the insured individual. This type of coverage often offers more flexibility, investment options, and opportunities for the policyholder to access funds during their lifetime, making it a more comprehensive and holistic approach to life insurance.

Benefits of Long-Term Coverage

Long-term coverage in life insurance offers a range of advantages that can significantly impact policyholders in a positive way. Not only does it provide financial security, but it also offers peace of mind knowing that one's future and loved ones are protected.

Financial Stability

Having long-term coverage ensures that policyholders have a safety net in place for the future. In the event of unforeseen circumstances such as illness, disability, or death, the policy can provide financial support to cover expenses and maintain a certain standard of living for the insured and their family.

Legacy Planning

Long-term coverage allows individuals to plan for their legacy and ensure that their loved ones are taken care of even after they are gone. By designating beneficiaries and setting up a comprehensive life insurance policy, policyholders can leave behind a financial safety net for their family members.

Retirement Income

Some life insurance policies offer cash value accumulation over time, which can be utilized as a source of retirement income. By investing in a long-term coverage plan, individuals can secure a stream of income during their retirement years, providing additional financial stability and peace of mind.

Factors to Consider in Sustainable Life Coverage

When selecting sustainable life coverage with long-term benefits, there are key factors that individuals should consider to ensure they choose the right policy for their needs. It is essential to compare different types of policies that offer long-term benefits and understand how factors like premiums, coverage limits, and sustainability play a crucial role in making the right decision.

Types of Policies Offering Long-Term Benefits

- Whole Life Insurance: Provides coverage for the entire life of the insured and includes a cash value component that grows over time.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits, allowing policyholders to adjust coverage as needed.

- Term Life Insurance: Provides coverage for a specific term, usually 10, 20, or 30 years, and is more affordable compared to whole life or universal life insurance.

Factors Impacting Coverage Selection

- Premiums: The amount you pay for your policy can vary significantly based on the type of coverage, your age, health, and lifestyle habits. It's essential to choose a premium that is affordable and sustainable in the long run.

- Coverage Limits: Understanding the coverage limits of a policy is crucial to ensure that your loved ones are adequately protected in case of your untimely death. Consider factors like outstanding debts, income replacement needs, and future expenses.

- Sustainability: Opting for a policy that is financially stable and sustainable over the long term is vital to ensure that your coverage remains intact and your beneficiaries receive the intended benefits. Look for reputable insurance companies with a strong track record of financial stability.

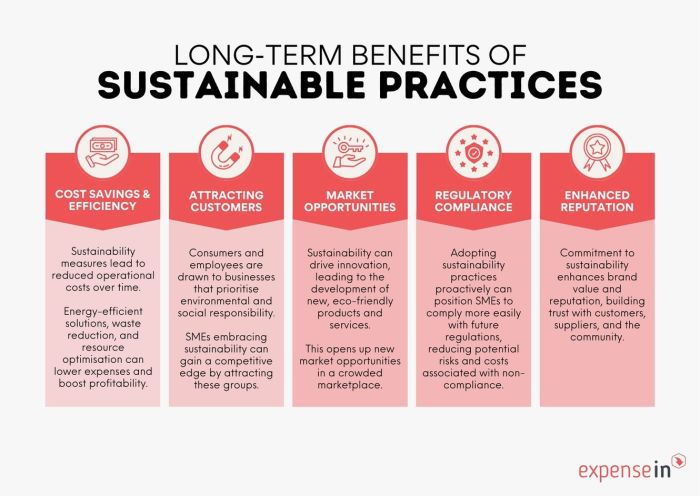

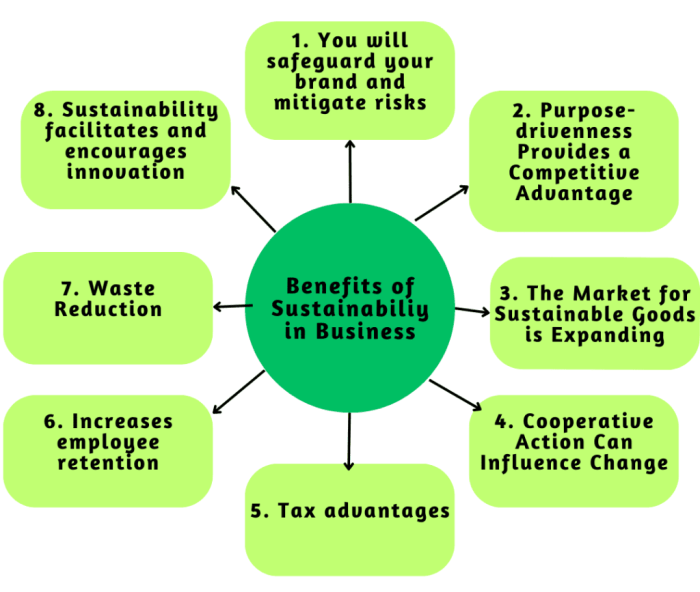

Sustainable Practices in Life Insurance

As the importance of sustainability continues to grow, the life insurance industry has also started to adopt sustainable practices. These practices not only benefit the environment but also contribute to social responsibility.

Alignment with Environmental and Social Responsibility

- Insurers are increasingly incorporating ESG (Environmental, Social, and Governance) factors into their investment decisions to support sustainable initiatives.

- Some insurance companies offer discounts or incentives to policyholders who choose eco-friendly options, such as paperless billing or electric vehicles.

- By promoting sustainable practices, insurers can help mitigate climate change and support community development projects.

Examples of Insurers Prioritizing Sustainability

- AXA Group: AXA has committed to divesting from coal and increasing investments in green technologies to support a more sustainable future.

- Allianz: Allianz has integrated ESG criteria into its underwriting and investment processes to align with sustainable development goals.

- Prudential Financial: Prudential has set targets to reduce greenhouse gas emissions and promote diversity and inclusion within its workforce.

Outcome Summary

In conclusion, Sustainable Life Coverage with Long-Term Benefits offers a beacon of financial security and peace of mind for individuals seeking lasting protection. By understanding the importance of sustainable practices in insurance, one can navigate the complexities of coverage options with confidence and foresight.

User Queries

What sets sustainable life coverage apart from traditional life insurance?

Sustainable life coverage focuses on long-term benefits and aligns with environmental and social responsibility, whereas traditional life insurance may not have sustainability as a core principle.

How do long-term benefits in life insurance contribute to financial security?

Long-term benefits provide a stable financial foundation over time, ensuring policyholders have a safety net for the future and can plan for unforeseen circumstances.

What key factors should individuals consider when selecting sustainable life coverage?

Factors such as premiums, coverage limits, sustainability of the policy, and the insurer's commitment to sustainable practices should all be taken into account.